Some Ideas on Clark Wealth Partners You Need To Know

Fascination About Clark Wealth Partners

Table of Contents6 Easy Facts About Clark Wealth Partners ShownNot known Details About Clark Wealth Partners Some Ideas on Clark Wealth Partners You Need To KnowThe smart Trick of Clark Wealth Partners That Nobody is DiscussingThe Basic Principles Of Clark Wealth Partners Clark Wealth Partners Fundamentals ExplainedHow Clark Wealth Partners can Save You Time, Stress, and Money.Fascination About Clark Wealth Partners

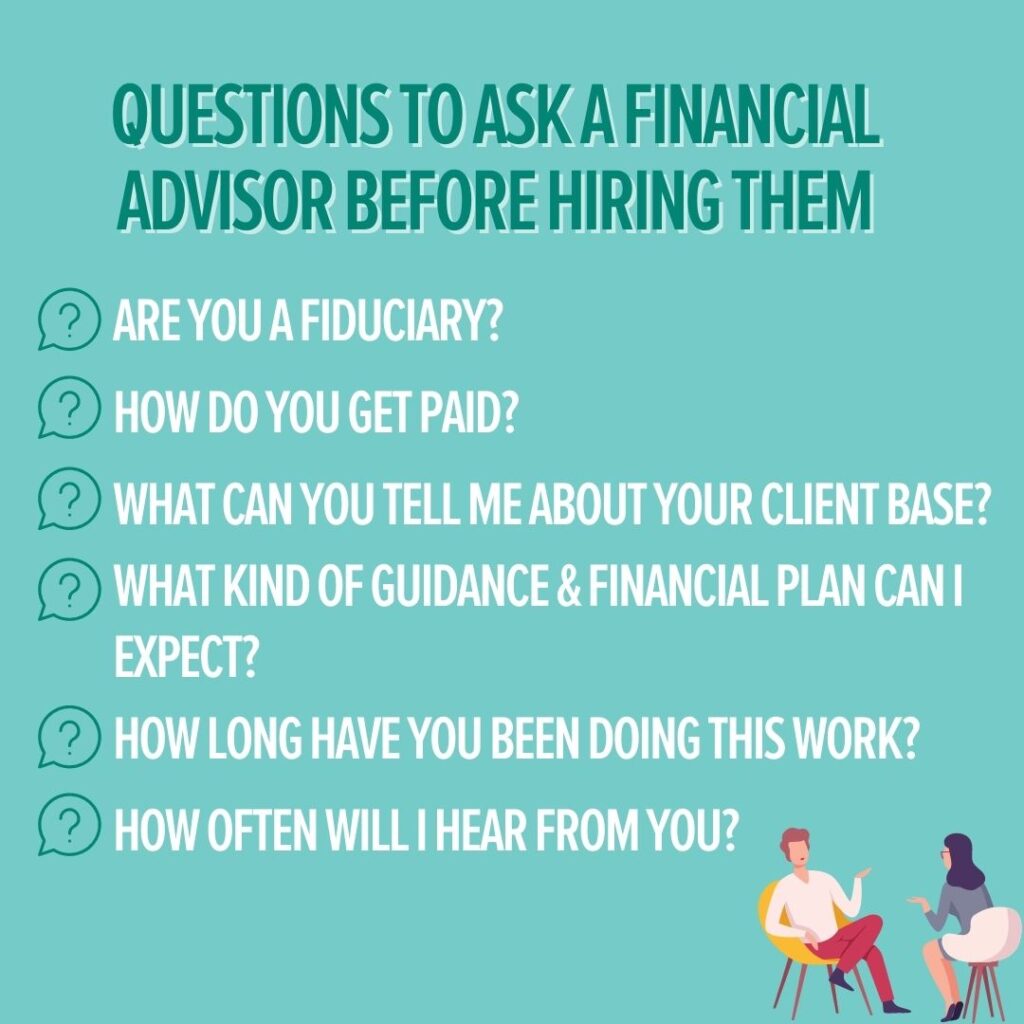

Usual reasons to think about a financial expert are: If your economic scenario has actually ended up being more complex, or you do not have self-confidence in your money-managing skills. Conserving or navigating significant life events like marital relationship, divorce, kids, inheritance, or work modification that might considerably influence your financial circumstance. Navigating the shift from conserving for retirement to preserving wealth throughout retired life and how to produce a strong retirement earnings plan.New technology has brought about more thorough automated monetary devices, like robo-advisors. It's up to you to examine and establish the appropriate fit - https://www.40billion.com/profile/714727223. Ultimately, a great economic advisor ought to be as conscious of your financial investments as they are with their own, preventing too much costs, saving money on tax obligations, and being as clear as feasible about your gains and losses

The Single Strategy To Use For Clark Wealth Partners

Earning a commission on product suggestions does not always imply your fee-based consultant works versus your benefits. They may be a lot more likely to recommend products and solutions on which they earn a payment, which may or might not be in your ideal passion. A fiduciary is legally bound to put their client's passions.

They might comply with a freely kept track of "viability" standard if they're not signed up fiduciaries. This common enables them to make suggestions for investments and solutions as long as they fit their customer's goals, risk resistance, and economic circumstance. This can translate to referrals that will likewise gain them cash. On the various other hand, fiduciary consultants are legitimately bound to act in their client's ideal rate of interest instead of their own.

The Main Principles Of Clark Wealth Partners

ExperienceTessa reported on all points investing deep-diving right into complicated economic topics, losing light on lesser-known financial investment avenues, and uncovering methods viewers can function the system to their benefit. As a personal finance professional in her 20s, Tessa is acutely familiar with the influences time and unpredictability carry your financial investment decisions.

It was a targeted ad, and it worked. Find out more Read less.

Things about Clark Wealth Partners

There's no solitary path to ending up being one, with some individuals beginning in financial or insurance coverage, while others begin in accounting. A four-year degree provides a strong structure for professions in investments, budgeting, and customer solutions.

Facts About Clark Wealth Partners Uncovered

Common instances include the FINRA Series 7 and Collection 65 examinations for securities, or a state-issued insurance policy license for offering life or medical insurance. While credentials may not be lawfully required for all preparing duties, companies and customers typically watch them as a standard of professionalism and reliability. We look at optional credentials in the next section.

Most financial coordinators have 1-3 years of experience and experience with monetary products, compliance requirements, and straight client interaction. A strong academic background is necessary, however experience demonstrates the ability to apply theory in real-world setups. Some programs combine both, permitting you to finish coursework while gaining monitored hours via teaching fellowships and practicums.

Clark Wealth Partners - Questions

Very early years can bring long hours, stress to develop a customer base, and the need to consistently verify your competence. Financial planners delight in the opportunity to work closely with customers, overview crucial life decisions, and usually attain versatility in schedules or self-employment.

Wide range supervisors can increase their incomes via payments, asset costs, and efficiency perks. Financial supervisors manage a group of economic planners and advisors, establishing department approach, handling compliance, budgeting, and guiding inner procedures. They invested much less time on the client-facing side of the industry. Almost all monetary managers hold a bachelor's level, and lots of have an MBA or comparable academic degree.

How Clark Wealth Partners can Save You Time, Stress, and Money.

Optional accreditations, such as the CFP, commonly need additional coursework and testing, which can extend the timeline by a number of years. According to the Bureau of Labor Stats, personal economic advisors gain a typical annual yearly salary of $102,140, with leading earners making over $239,000.

In other provinces, there are laws that require them to meet specific requirements to utilize the financial expert or economic planner titles (financial planner scott afb il). What sets some financial advisors besides others are education and learning, training, experience and certifications. There are many designations for monetary consultants. For financial coordinators, there are 3 typical classifications: Qualified, Personal and Registered Financial her comment is here Planner.

6 Easy Facts About Clark Wealth Partners Described

Where to discover a monetary consultant will certainly depend on the kind of suggestions you need. These institutions have team that might assist you comprehend and buy specific types of financial investments.